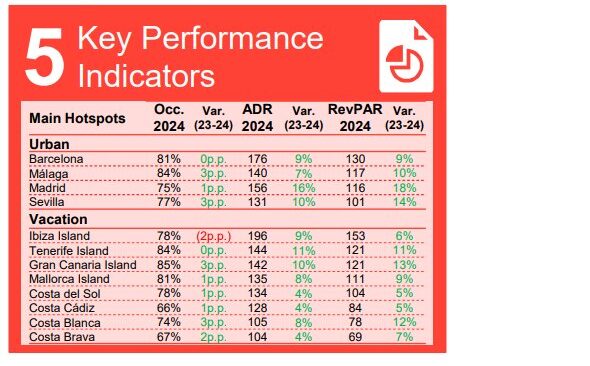

Ibiza continues to be one of the most solid destinations on the Spanish hotel scene, despite the slight slowdown in the national tourism investment market. According to The Hotel Property Telescope 2025 report, prepared by EY-Parthenon, the island reached an average occupancy rate of 78% in 2024, two points below the previous year, but maintained an average daily rate (ADR) of 196 euros and revenue per available room (RevPAR) of 153 euros, figures that place it among the most profitable markets in Spain.

The report notes that pressure on margins has been intensified by rising labor and food costs, as well as the negotiation of new collective bargaining agreements. Nevertheless, international tourism continues to be the engine that sustains profitability in the Balearic Islands, especially in Ibiza, where the average expenditure per visitor and the high loyalty of foreign clients compensate for the drop in domestic tourism.

Restrictions on new tourist accommodation licenses imposed by local authorities have limited supply, contributing to high prices and continued investor interest. In this regard, experts point out that the predominant strategy in the archipelago is the repositioning of existing assets and the commitment to “asset light” management models , in which the operator focuses on the brand and management, while the capital comes from institutional partners.

Balearic Islands, epicenter of vacation investment

In the Balearic Islands as a whole, the indicators show a stable trend, with Mallorca registering 81% occupancy and an average ADR of 135 euros, while Tenerife and Gran Canaria lead the national vacation segment with occupancy levels above 84%. Even so, Ibiza stands out for having the highest average rate in the whole country, surpassing even Barcelona and Madrid.

The archipelago remains attractive to large international funds, although the rising cost of assets and the scarcity of opportunities limit the pace of new acquisitions. The current priority is focused on renovating mature establishments and adapting the offer to the luxury and sustainability segment, two key axes for the destination’s competitiveness.

National context: Spain, European leader in hotel investment

Domestically, Spain is consolidating its position as the leading hotel investment destination in Europe, with a volume of €1.8 billion in the first half of 2025, up 7% on the previous year, according to EY-Parthenon. Despite the lower presence of large portfolios and luxury operations, the country remains the benchmark in the continental market, ahead of Italy (1.3 billion) and France.

Institutional and private equity investment has regained strength, representing 41% of the total, while hotel operators maintain their leadership with a 42% share. Co-investment models and strategic alliances between hotel groups and financial institutions are marking the new stage of growth in the sector.

At the macroeconomic level, the report forecasts a moderation of Spanish GDP to 2.3% in the second half of the year, due to the persistence of inflation in services and the slowdown in domestic consumption. However, international demand remains at record levels, with a 6% growth in arrivals and an 8% increase in tourism spending in the first months of 2025, especially driving southern vacation destinations and the islands.